Chime Resolves Refund Delays: Works with Vendor to Compensate Impacted Customers

I always keep an eye on the latest developments in the banking industry, especially when it involves customer service improvements. Recently, Chime, the popular online banking service, faced scrutiny over delayed refunds to customers. However, the way Chime handled the situation demonstrates their commitment to resolving issues and improving customer experience.

Addressing the Issue Head-On

The Biden administration, through the Consumer Financial Protection Bureau (CFPB), ordered Chime to pay $4.55 million due to delays in issuing refunds to customers who had closed their accounts. The CFPB’s investigation revealed that Chime had delayed refunds for thousands of customers, sometimes for up to 90 days, which caused significant inconvenience and financial strain.

Chime responded promptly and positively to the CFPB’s findings. The company acknowledged that the delays were primarily caused by a configuration error with a third-party vendor during 2020 and 2021. As soon as Chime identified the issue, they collaborated with their vendor to rectify the error and ensure refunds were issued to the affected customers.

In a statement, Chime emphasized their commitment to customer satisfaction: “When Chime discovered the issue, we worked with our vendor to resolve the error and issued refunds to impacted consumers.” This proactive approach highlights Chime’s dedication to maintaining trust and transparency with their users.

Commitment to Improvement

Chime’s settlement with the CFPB includes $1.3 million in compensation to affected consumers and a $3.25 million penalty. This resolution reflects Chime’s belief in the importance of timely handling of customer matters, even amid the challenges posed by the pandemic. “We share the Bureau’s goal to create a more competitive and accessible financial landscape that is good for everyday consumers,” Chime stated, underlining their mission to enhance financial services for all.

Looking Ahead

Chime’s experience with this issue serves as a valuable lesson in the importance of robust customer service and quick problem-solving. Their commitment to resolving the matter and improving their processes is a positive step towards ensuring a better banking experience for their users.

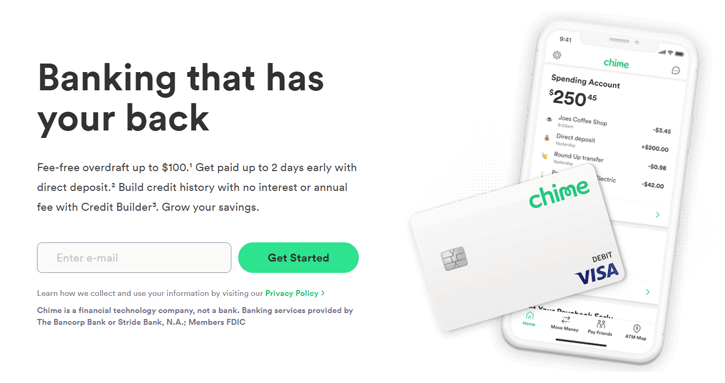

For those looking to explore the benefits of modern online banking, Chime remains a strong option. If you’re interested in joining Chime and experiencing their services firsthand, consider using this Chime referral link to get started.

References: