M1 Finance Fined by FINRA: Why You Shouldn’t Be Bothered by This Hiccup

I’m always keen to keep you informed about the latest happenings in the financial industry. Recently, M1 Finance was fined $850,000 by the Financial Industry Regulatory Authority (FINRA) for issues related to promotional content shared by influencers. While this might sound alarming at first, I want to explain why this regulatory hiccup shouldn’t deter you from considering M1 Finance as your go-to financial platform.

The Rise of Finfluencers

Social media platforms like TikTok have revolutionized how millennials and Gen Zers access financial information. Nearly 80% of these demographics turn to these platforms for advice, democratizing financial knowledge and breaking down traditional barriers. However, this shift has also introduced risks. Popular yet potentially unqualified individuals, known as finfluencers, often share financial guidance that may be biased or misleading, thanks to algorithmic content distribution.

A Kansas City Fed report highlighted the pros and cons of social media in financial education. While these platforms offer unparalleled access to information, they also host influencers who might prioritize the interests of financial providers over their audience. This can lead to biased recommendations and misinformation, highlighting the need for vigilant oversight.

The recent $850,000 fine against M1 Finance is a clear example of regulators taking proactive steps to protect consumers from misleading financial advice. This penalty stems from promotional content shared by influencers on behalf of M1 Finance, shedding light on the complex dynamics of using social media influencers in financial marketing. It sends a strong message to the financial services sector: regulatory bodies are actively monitoring compliance to protect consumer interests.

Why You Shouldn’t Be Bothered

Now, let’s break down why this fine shouldn’t worry you:

- Proactive Improvement: The fine shows that M1 Finance is under regulatory scrutiny, which means the platform is continuously improving to meet the highest standards. This oversight ensures that M1 Finance will be more robust and reliable moving forward.

- Transparency and Accountability: M1 Finance’s response to the fine demonstrates their commitment to transparency and accountability. They are addressing the issues head-on, which is a positive sign of a responsible company.

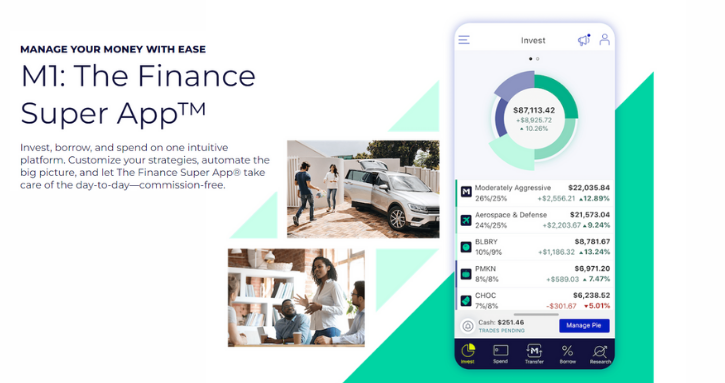

- Unmatched Features: Despite this regulatory hiccup, M1 Finance continues to offer a powerful suite of tools for investing, saving, and managing your finances. The platform’s features and benefits far outweigh this temporary setback.

- Consumer Focus: M1 Finance’s primary focus remains on providing excellent service and value to its users. Their proactive measures to comply with regulations show a dedication to user safety and satisfaction.

Why I Still Recommend M1 Finance

Despite this fine, I firmly believe in the value M1 Finance offers. It’s a powerful platform for investing, saving, and managing your finances. If you’re looking for a robust tool to help you take control of your financial future, consider signing up for M1 Finance. You can use my M1 Finance referral link to get started and enjoy the benefits of smart, fee-free investing.

Final Thoughts

The M1 Finance fine serves as a reminder of the evolving landscape of financial advice and the importance of regulatory oversight. As we continue to leverage social media for financial education, it’s crucial to remain vigilant and informed. This regulatory action ensures that companies like M1 Finance remain committed to high standards, ultimately benefiting us, the consumers.

Don’t let this hiccup deter you from experiencing the advantages of M1 Finance. Stay informed, and let’s continue advocating for better standards and practices in the financial industry.

References: