6 Ways Chime Makes Money: Understanding Chime’s Fee-Free Model

Chime is part of a new wave of fintech, challenging traditional banking norms by offering consumer-friendly services. Founded in 2013, Chime has grown rapidly by centering its model around a fee-free structure, attracting millions who are tired of being nickel-and-dimed by their banks. Discovering ways Chime makes money without charging these fees requires looking into the mechanics of modern banking and the strategic partnerships that enable revenue generation in less direct, but customer-centric, ways.

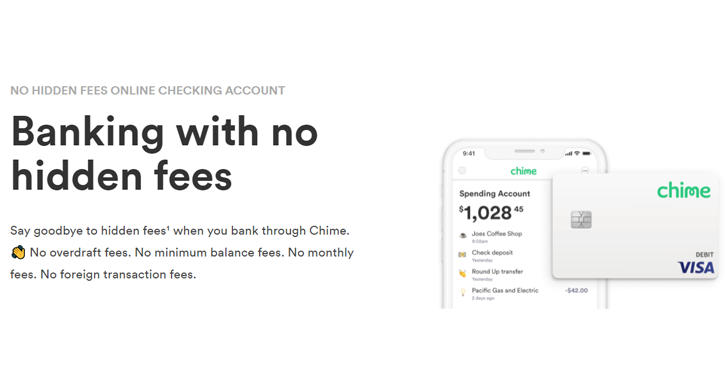

In a generation where traditional banks are often overloaded with fees, Chime’s no-fee digital banking platform appears almost too good to be true. With no overdraft, monthly service, transfer, or foreign transaction fees, customers are understandably curious about how Chime sustains its business.

1. Interchange Fees

The primary source of Chime’s income is interchange fees. Every time a Chime customer uses their Visa debit card, merchants pay a small fee to the customer’s issuing bank, which, in this case, is Chime. These fees are a standard part of the banking industry, and while they’re relatively small on a per-transaction basis, they add up quickly with millions of users swiping their Chime cards for everyday purchases.

2. Out-of-Network ATM Fees

While Chime doesn’t charge customers for using an ATM, they do earn revenue from fees paid by customers who use out-of-network ATMs. These fees are charged not by Chime but by the ATM network or operator, and a portion is ultimately shared with Chime. To mitigate this and preserve the fee-free ethos, Chime has partnered with an extensive ATM network, allowing users access to tens of thousands of ATMs without fees.

3. The Role of Optional Services

Chime offers additional services that customers can choose to use for convenience. An example is the Chime Credit Builder Visa Credit Card, which helps users build credit history. There are no interest or annual fees, but Chime benefits from the interchange fees generated by credit card transactions, much like with their debit cards.

Additionally, Chime provides a service called SpotMe, which allows eligible users to overdraw their accounts on debit card purchases without incurring a fee. Chime covers the overdraft but encourages users to leave a tip, which is an optional source of revenue for the company.

4. A Lean, Digital-First Approach

Chime’s operational model plays a significant role in its ability to maintain profitability without customer fees. With no physical branch network to maintain, Chime saves on the overhead costs that burden many traditional banks. These savings enable Chime to focus resources on tech infrastructure and customer service excellence.

The cost savings also come from a lean and automated operational structure. By utilizing sophisticated technology and algorithms, Chime reduces the need for extensive human intervention in managing accounts and customer service inquiries. This digital-first approach allows for more efficient account management and customer support processes.

5. Earning Interest on Deposits

Like traditional banks, Chime earns revenue from the interest margin, which is the difference between the interest they pay on deposits and the interest they earn from loaning those deposits out or investing them. While Chime’s primary business is not lending, it still generates a significant amount of interest income by placing deposits into interest-bearing accounts with partner banks.

6. Capitalizing on Partnerships and Investments

Chime partners with other financial institutions to provide its banking services. These bank partners hold Chime customer deposits, which are insured by the Federal Deposit Insurance Corporation (FDIC). Through these strategic partnerships, Chime is able to offer competitive banking products, and the partner banks gain deposit growth and other reciprocal financial opportunities.

Moreover, as a private company, Chime relies on venture capital and private equity funding to fuel its growth and expansion. This investment capital allows Chime to prioritize its customer-centric model without the immediate pressure of generating short-term profits.

Is Chime’s Fee-Free Model Sustainable?

Critics often wonder if Chime’s model is sustainable in the long run, especially as the user base grows and the company seeks to expand its services. Chime’s ongoing success suggests that not only is its business model sustainable, but it’s also reshaping customer expectations for banking services. Exploring the various ways Chime makes money showcases its ability to thrive without relying on conventional fees, marking a significant shift in the financial industry landscape.

Conclusion

Chime is a forerunner in the world of digital banking, proving that banks can be profitable without imposing a litany of fees on their customers. By leveraging interchange fees, benefiting from strategic partnerships, and operating on a lean, digital-first model, Chime has managed to create a valuable proposition for consumers and a sustainable business model for itself.

As more consumers flock to Chime for its user-friendly and cost-effective services, traditional banks may need to revisit their fee structures to stay competitive. Chime’s success underscores a significant shift toward transparency and customer-centricity in banking—a trend that is likely to continue shaping the financial landscape in the years to come. Sign up for Chime bank today to get an instant $100 bonus!