This page may contain affiliate or referral links. When you subscribe, buy products, or open accounts through links on this site, we may earn a commission at no extra cost to you. The information on this page is current as of its publication date. However, offers may vary or expire due to delayed updates following changes in referral/affiliate programs.

Table of Contents

Businesses constantly seek simpler, faster, and more efficient ways to manage transactions. Among the overabundance of mobile payment services available, Cash App has began as a frequently discussed option. Known for its ease of use among individuals, the idea of using Cash App for business is enticing for many entrepreneurs. The question is whether Cash App is a suitable platform for your business, focusing on its utility for receiving payments, the tipping options it provides, and its overall appropriateness for commercial use.

Receiving Payments with Cash App

One of the most critical functions of any payment service for a business is the ability to receive payments reliably and conveniently. Cash App for business allows companies to accept payments directly from customers using a simple, user-friendly interface.

For small businesses and solopreneurs, the app offers straightforward utility: clients can pay for services or products with just a few taps on their smartphones, and funds typically appear in your business’s Cash App balance instantly. This immediacy can be a game-changer for cash flow, especially for those who are just starting and need to maintain a steady stream of income.

But it’s not only about speed. Cash App also provides a unique identifier known as a $Cashtag, which makes it simple for customers to remember where to send money without having to deal with lengthy bank account numbers or waiting for checks to clear. Moreover, the platform sends notifications for each transaction, which helps in keeping track of payments in real-time.

Tipping Made Easy

In hospitality businesses or any service industry where tipping is customary, Cash App could present a novel solution. The platform’s tipping feature allows customers to add a tip after they’ve paid for a service, simplifying the process for both the customer and the business.

Customers no longer need to worry about having cash on hand to tip, and as a business owner, you can ensure that your employees receive their well-earned gratuities directly and promptly. Furthermore, the tipping process via Cash App is transparent, which can be advantageous for record-keeping and accounting purposes.

Overall Suitability for Commercial Use

While the benefits mentioned above may paint a rosy picture, the question of whether Cash App for business is the right choice for commercial use depends on several factors. Let’s delve into some considerations that a business owner must account for when evaluating this payment service.

Cash App for Business Pros and Cons

| Pros | Cons |

|---|---|

|

|

Is Cash App for Business Right For You?

To determine if Cash App is a good fit, consider your business’s size, the average transaction amount, and your customer demographics. For small-scale operations where individual transactions aren’t exceedingly high, the simplicity and immediacy of Cash App can be invaluable. Conversely, if you operate a larger business with more complex financial management needs, you may require a more robust system with advanced features tailored to businesses.

A notable advantage of Cash App for business is that it’s a name many people already know and trust, which can make it easier to introduce as a payment option. If a significant portion of your customer base already uses Cash App for personal transactions, the transition to using it for business transactions could be seamless.

However, while adapting to digital payments is undoubtedly beneficial, relying solely on Cash App may not be prudent. It’s often best used in conjunction with other payment methods to ensure you can accommodate all of your customers’ preferences and needs.

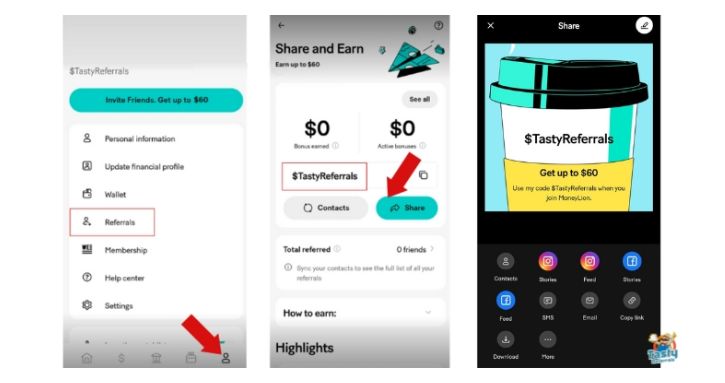

If you have already made up your mind, sign up with Cash App today to earn a Cash App referral bonus.

Conclusion

In sum, Cash App for business presents a compelling case for those seeking a straightforward and efficient way to handle transactions. It’s clear that for smaller businesses, freelancers, and those in the service industry, the benefits like immediate payments and easy tipping could make Cash App the right tool for economic empowerment.

But don’t rush the decision. Evaluate your specific circumstances, think about your customers, and consider how this payment service aligns with your business operations. For the right venture, Cash App for business could indeed be a perfect match, simplifying your transactions and allowing you to focus on what you do best—growing your business.

Investing Related Articles