This page may contain affiliate or referral links. When you subscribe, buy products, or open accounts through links on this site, we may earn a commission at no extra cost to you. The information on this page is current as of its publication date. However, offers may vary or expire due to delayed updates following changes in referral/affiliate programs.

Table of Contents

In this Cash App review, you will learn more about how Cash App works and what to expect. It’s easier than ever today to transfer money between friends and family without exchanging cash. The Cash App offers easy transfers and plenty of other ‘bonus benefits’ you won’t find with other money transfer services.

What is Cash App?

Founded by Jack Dorsey and Jim McKelvey, Cash App is a part of Square product portfolio. It’s Square’s peer-to-peer money payment service. The app allows users to send and receive money, and it also works like a bank account – you can carry a balance. Keep in mind, though, your balance doesn’t earn interest.

Need to send money to your roommate for rent? Did you split a restaurant bill with your brother? Quickly and easily send money using the app. Users also receive a Cash App debit card that they can use just like a bank debit card, making purchases in person and online. Users may also invest in stocks and trade bitcoin using Square’s money transfer app. This is just the beginning of this Cash App review. Let’s learn more below.

What can you do with Cash App?

Unlike competitor platforms such as Venmo and Paypal, you can do more with Cash App than just send money to your friends. In this Cash App review, we’ll discuss some of the main features of Cash App. For a full list of more fun things that you can do with Cash App, aside from this Cash App review, you can also read about 13 things you can do with Cash App.

1. Send and receive money

This is Cash App’s primary service. Both personal and business users may send and receive money. Just like Venmo or Paypal, you will have a unique username called a $Cashtag. This unique identifier enables users to pay each other quickly. Choose your $Cashtag and share it with friends and family. You may only change your tag twice. You can also pay someone using their $Cashtag.

2. Get a custom debit card

Use your debit card anywhere that accepts Visa, including online. Pay for goods or services from your Cash App balance with the card. You can also add it to your Apple Pay or Google Pay platform.

3. Trade fractional shares of stocks

You can invest in stocks either wholly or as a fractional share. For example, if you have $5 to invest, but a share costs $10, you can buy a fractional share and earn prorated earnings on your investment.

4. Invest in Bitcoin

You can buy Bitcoin using your Square money transfer app balance. You may also sell Bitcoin you bought with Cash App. There are fees for both buying and selling Bitcoin-based on market volatility.

5. Get market updates

If you’re investing, you must know the latest trends, stock moves, and even how to invest (if you’re a beginner). Cash App offers all of this information right in the app.

6. Save money

Using your Cash Card, you can get discounts at participating merchants. Just select the offer on your Cash App (Cash Boost) home page, make the purchase, and save instantly.

What Are The Cash App Fees?

Personal use users don’t pay a fee to send or receive money if using a personal bank account or debit card. If you pay with a credit card, there’s a 3% fee. If you want instant access to the funds (they typically take 1 -3 business days to clear), you’ll also pay a 1.5% quick deposit fee. Business account users pay a 2.75% fee for payments received.

Cash App Fees

| Activity | Fee |

|---|---|

| Receive/Send Money | $0 |

| 1-3 Day Deposit | $0 |

| Quick Deposit | 1.5% |

| ATM Withdrawal | $2 |

| Business Payments Received | 2.75% |

| Send Money with Credit Card | 3% |

Cash App Pros and Cons

| Pros | Cons |

|---|---|

|

|

Square Cash App vs. PayPal

Sending and Receiving Funds

Anyone can have a PayPal account, sending and receiving money for free (except businesses). Like Cash App, you can spend money in your PayPal account or linked bank account. PayPal provides a PayPal Visa or MasterCard, which you can use anywhere that accepts the cards.

Fees

Sending and receiving funds is free as long as you use your PayPal balance or linked bank account. Senders using a credit card, pay a 2.9% plus $0.30 fee per transaction. PayPal also charges a 1% instant transfer fee for immediate funds access up to a $10 fee.

Speed

Deposits take 1 -3 business days, but you have the option for an instant deposit for a 1% fee.

Fraud Protection

PayPal offers buyer and seller protection for fraudulent activity, but not for individuals.

Read Cash App vs Paypal for a complete comparison.

Square Cash App vs. Venmo

Sending and Receiving Funds

Like Square Cash, Venmo allows money transfers between friends and family. Only approved businesses may use Venmo, though. You can spend the money in your Venmo account or linked bank account if Venmo funds aren’t available. Venmo provides a ‘Venmo card’ which you can use only at merchants that accept it (unlike the Cash App Visa card).

Like Square, Venmo withdraws the funds from your Venmo account. If unavailable, they’ll draw from your linked bank account or credit card (but there’s a fee). You can have the funds you receive deposited right into your bank account.

Fees

There’s no fee to send or receive payments when using your Venmo personal balance or linked debit card or bank account. If you send money with a credit card, there’s a 3% fee. Instant transfers also have a fee of 1% of the transfer amount.

Speed

Deposits take the standard 1 – 3 business days, but many Venmo transfers occur by the next business day.

Fraud Protection

Venmo doesn’t offer fraud protection. They encourage users to send and receive money only from people they know.

Read Cash App vs Venmo for a complete comparison of both platforms.

Square Cash App vs. Zelle

Sending and Receiving Funds

Zelle works a little differently. Rather than withdrawing funds from your Cash App balance, for example, Zelle withdraws directly from your bank account. Zelle also deposits funds directly in the recipient’s bank account. All you need is the recipient’s phone number or email to send funds.

Fees

Zelle doesn’t charge any fees, however, your bank may charge fees, so always check with your bank first.

Speed

Zelle transfers are immediate (for no extra fee). The money transfers from your bank account and directly to the recipient’s bank account or vice versa.

Fraud Protection

Zelle doesn’t offer any fraud protection. They recommend you only send and receive money from people you know.

Read Cash App vs Zelle to help you decide better on which platform would work for you.

Square Cash App vs. Google Pay

Sending and Receiving Funds

Users link a bank account or debit card to their Google Pay account to send and receive funds. You set the default payment method, and the money comes from that account when you make purchases. Friends and family can send you money too. You’ll receive an email or text (depending on the information you provided) and then Google Pay directs the money to your default account.

You may also keep the funds in your Google Pay balance.

Fees

Google Pay doesn’t charge any fees.

Speed

Google Pay transfers are immediate to your Google Pay account. Any transfers to your bank account may take 1 – 4 business days.

Fraud Protection

Google Pay has powerful fraud protection. Their system continually looks for fraudulent activity and if it suspects it, cancels all transactions involved with that credit card.

Cash App Fraud Protection

The Cash App has the same fraud detection Square offers its business customers. All information is encrypted, but fraud may still occur.

Cash App has security features, such as PIN entry or Face ID verification. You may also disable Cash App if you suspect fraud and set up text alerts to know when your account’s been used. If you suspect fraudulent activity, contact Square right away.

Cash App Limitations

Cash App allows you to send up to $250 in a 7-day period. You may also receive up to $1,000 in a 30-day period. You can increase the limits by fully verifying your identity with your full name, birth date, and the last four digits of your Social Security number.

The Cash Card has higher limits. You may withdraw up to $250 per day (per transaction) and up to $1,000 per week or $1,250 per month.

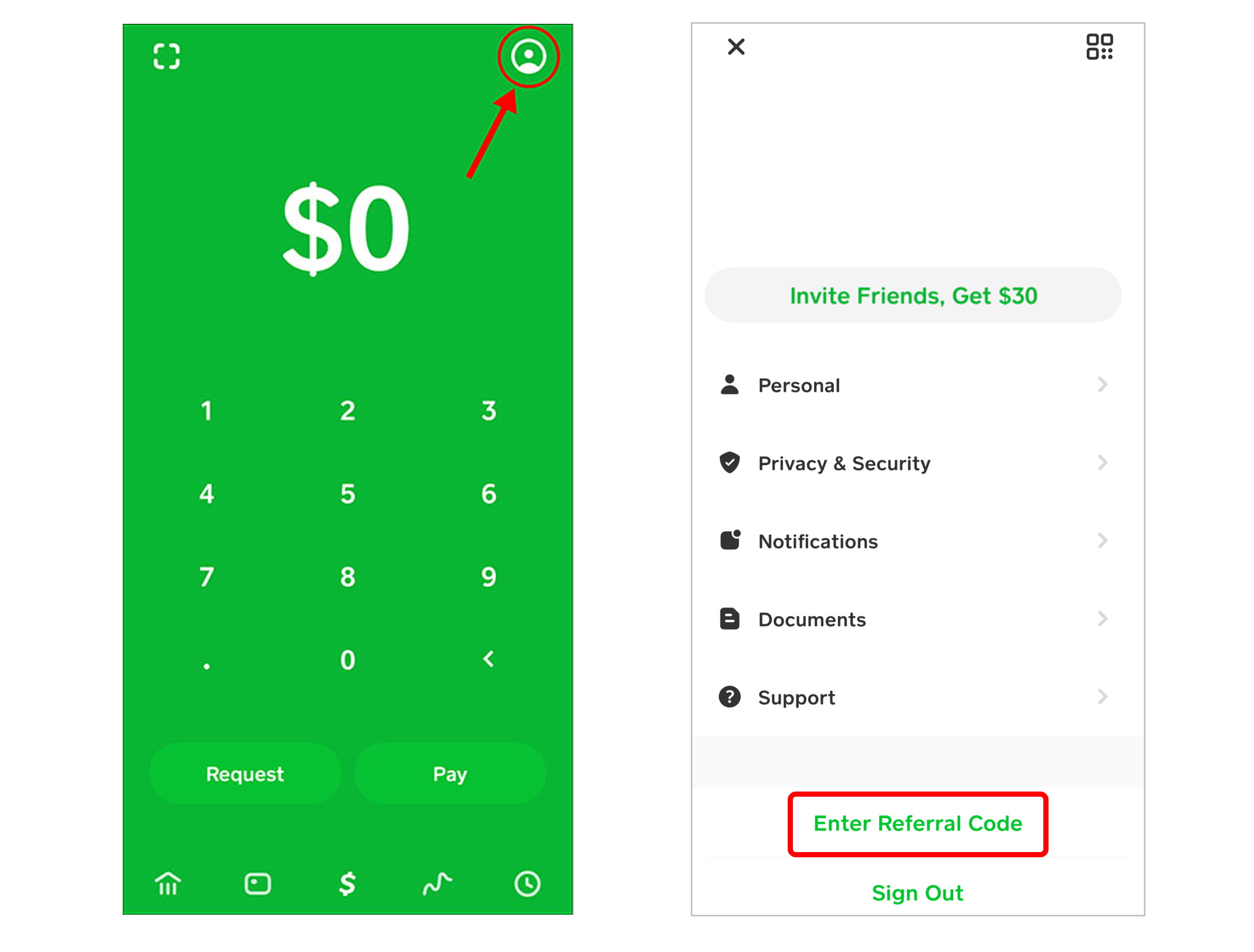

Cash App Referral Program

Each time you refer a friend to Cash App and they use the app to send at least $5, you will receive up to $30. Your referral must send money within 14 days of signing up. Read my Cash App Referral post to learn how you can make up to $15 when you sign-up for Cash App.

The Bottom Line

The Cash App offers a safe way to transfer funds between friends and family. The fees are similar to most other P2P cash transfer services, as is the speed that you receive funds. Square’s P2P transfer app has a few other ‘bonuses’ that other apps don’t offer, though. A learning nugget from this Cash App Review, if you’re into investing, have an interest in Bitcoin, or love saving money, you may get more out of the Cash App features than its competitors.

Investing Related Articles