This page may contain affiliate or referral links. When you subscribe, buy products, or open accounts through links on this site, we may earn a commission at no extra cost to you. The information on this page is current as of its publication date. However, offers may vary or expire due to delayed updates following changes in referral/affiliate programs.

Table of Contents

- What is Cash App?

- How Cash App Became a Multi-Billion Dollar Company

- 5 Cash App Statistics You Should Know

- How Much Money Does Cash App Make?

- How Does Cash App Make Money?

- Cash App’s Parent Company – Block, Inc.

- Sign Up for Cash App and Get $5

- Final Thoughts: Using Cash App in 2024

- Leave A Comment Cancel reply

Your digital wallet empowers you to make payments and receive money quicker than ever. Cash App is one of the most popular mobile payment services with over 70 million active users in September 2021. Think of it as the next step up from PayPal as a peer-to-peer payment service.

Cash App allows you to send and receive money without the hassle of bank details and delays. The platform has evolved to become almost unrecognizable since its launch in 2013 by integrating new services, including bitcoin trading, its major revenue source.

It’s an alternative to PayPal – and its subsidiary Venmo – as a digital money account that empowers you to buy bitcoin, invest in stocks, and send money in seconds. We’re exploring everything you need to know about Cash App’s revenue and usage statistics to help you get the most out of this payment app.

What is Cash App?

Cash App began as ‘Square Cash’ in 2013 and was launched by Block, Inc. This company was previously known as Square Inc. at the time of the service’s launch. The platform was designed to allow users to send, receive, and store money in a digital wallet in the US and UK, using their bank account to transfer money.

It’s free to open an account with Cash App to make peer to-peer payments and transfer the money in your Cash App to your bank account. The platform also has a ‘Cash Card’, allowing you to use your Cash App balance to make in-store and online payments.

Cash App has developed over time to offer bitcoin trading and stock investing. It’s currently testing new financial features to allow users to borrow up to $200. Get to know about Cash App more in our Cash App Review.

How Cash App Became a Multi-Billion Dollar Company

In 2015, Square introduced a business account with a ‘$cashtag’ username to make it easier for businesses to send and receive money, taking its inspiration from Twitter handles. It removed the need for businesses to share their bank details and speeds up transactions. Square Cash for Businesses offered Square the first way of monetizing its services.

The biggest upgrade came in 2017 when Cash App launched the Cash Card, an option that almost 1/3 of Cash App users avail of. Cash App extended beyond traditional accounts in 2018 with the introduction of bitcoin trading and in 2019 with stock trading, both of which feed in generously to Cash App’s revenue.

Square purchased Credit Karma Tax, a free tax-filing service, in 2020 and integrated it into the Cash App software. Cash App launched its first junior accounts for teenagers aged 13 to 17 in November 2021 after previously requiring users to be at least 19 years old.

Cash App has gone beyond being a digital payment service. Its software expansion and additions like stock trading make it a rival to other fintech, including Robinhood.

Square purchased Credit Karma Tax, a free tax-filing service, in 2020 and integrated it into the Cash App software. Cash App launched its first junior accounts for teenagers aged 13 to 17 in November 2021 after previously requiring users to be at least 19 years old.

Cash App has gone beyond being a digital payment service. Its software expansion and additions like stock trading make it a rival to other fintech, including Robinhood.

5 Cash App Statistics You Should Know

It’s easy to get caught up in the headlines of Cash App, especially its meteoric rise in recent years. Here are 5 Cash App statistics that show how far the company has come since 2017 and how much revenue Cash App makes.

1. Before 2015, Square was losing money when customers signed up for Cash App. By 2017, they were generating an average of $15 per customer in revenue. This figure is now estimated to be around $30 per customer.

2. Cash App’s bitcoin trading accounted for 76% of the platform’s revenue in 2020. This figure jumped to 81% in 2021.

3. Cash App has over 100 million downloads with 44 million monthly active users, most of them based in the United States. It’s a similar figure to competing peer-to-peer payment platforms, including Venmo.

4. The platform was valued at $73.5 billion in 2021 with Block, Inc’s market capitalization valued at $78.5 billion in Q1 of 2022.

5. Over 1,100 people work for Cash App to keep the peer-to-peer payment and trading app working reliably around the clock.

How Much Money Does Cash App Make?

Cash App wasn’t always making money. It only started bringing in significant revenue after the launch of its bitcoin trading in 2018. Previously, Cash App was losing revenue when customers signed up before 2015 before doubling its per-customer revenue from $15 to $30.

While this figure may appear eyewatering, most of its bitcoin revenue is used to finance the platform. It made over $2 billion in gross profits in 2021 after making $1.23 billion in 2020 and $0.45 billion in 2019.

While Cash App offers a referral program, there’s no information provided by the company on its referral budget. You can earn $5 when you sign up to Cash App using a referral link and when you someone else uses your referral link to join Cash App.

How Does Cash App Make Money?

After not making money for several years, Cash App now has several streams of revenue in its business. Most of its income is made through bitcoin trading, as well as nominal fees that are passed onto customers.

Cash App makes money by charging 0.5-1.75% of the transfer value for instant money withdrawals, while two to three-day transfers are free. The platform also charges 3% on credit card transactions.

Business accounts are also charged 2.75% per transaction from customers who use a Cash Card or make a payment through the Cash App.

The platform’s bitcoin trading made up 81% of its total revenue in 2021 after going through sustainable growth since 2019. Bitcoin trading earned Cash App $0.41 billion in 2019 before jumping to $4.56 billion in 2020 and almost doubling to $10.02 billion in 2021.

Cash App generates revenue through its bitcoin trading by charging 1.76% fees on bitcoin purchases and adding on a service fee of 1 to 4%, the difference between what the individual pays for their bitcoin and the bitcoin exchange. For example, Cash App will typically make at least $10 when it buys $100 of bitcoin from one user and sells it to another at $90.

Cash App’s Parent Company – Block, Inc.

When Cash App was launched, its parent company was known as Square Inc. It changed its name in 2021 to Block, Inc. Cash App makes up roughly 65% of the company’s market cap. The platform has had a series of interesting board members, including Jay-Z.

Block, Inc. is on the stock market under its previous SQ ticker. The company was founded by Jack Dorsey and Jim McKelvey in 2009 and named after its namesake product, Square. It’s a payment platform designed for small and medium businesses to enable them to accept credit card payments and payments from smartphones and devices.

Cash App was the company’s second venture before it began acquiring other companies, including Afterpay, a buy-now-pay-later service. It also owns Weebly, a web hosting service, and Tidal, a subscription service for videos, podcasts, and music.

Block, Inc. has over 8,500 employees across its companies and made $17.66 billion in revenue in 2021 with an operating income of $232.24 million. The company also acquired Zest, a food delivery service for corporate offices, in 2018 and Credit Karma Tax in 2020.

Sign Up for Cash App and Get $5

Are you interested in signing up for Cash App? The platform has something to offer everyone, from its stock trading to digital payment services. Users in the UK and the US can join Cash App with other regions expected to join the platform soon.

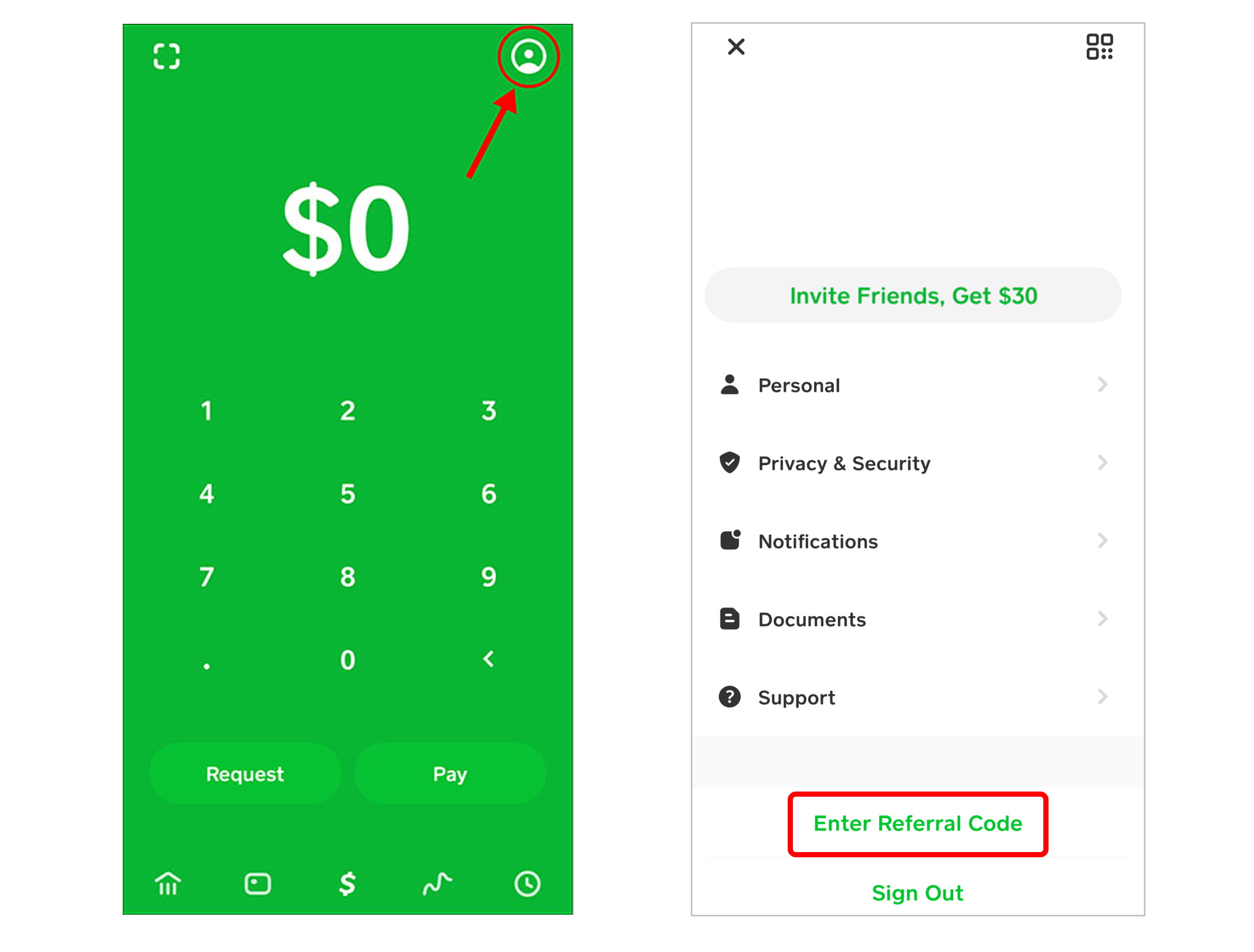

You can get a $5 sign-up bonus by joining Cash App through our Cash App referral link or by using the code FRLSRVM. It’s easy to meet the requirements for your $5 bonus. Link your debit card or bank account to your Cash App profile and send $5 to another Cash App user within the first 14 days of having your account.

Cash App allows you to earn up to $30 by inviting your friends and family to sign up for Cash App by using your referral code. It’s an easy way to earn free money and top up your Cash App balance.

Final Thoughts: Using Cash App in 2024

Cash App is one of the world’s largest payment processing companies with a presence in the United States and the United Kingdom. It’s used by individuals and businesses to quickly send and receive cash, as well as utilizing services like bitcoin trading and stock investing.

The platform is the biggest rival to Venmo but goes beyond being a peer-to-peer payment service. Bitcoin is the company’s prime source of revenue, which is why it features heavily in the company’s marketing.

Cash App is the best peer-to-peer payment service for those who want to streamline their financial activity into one platform. If you’re a bitcoin trader or want to start investing, you can do it all through Cash App.

Don’t forget to sign up using our Cash App $5 code to get $5 free when you send $5 to another Cash App user and link your bank account or credit card within the first 14 days. You can start earning free money on Cash Ap by sharing your referral code with your friends and family.

Investing Related Articles